Table of Content

Great highway visibility for your dream home even. Highly desirable area of Berkley. Hard to find, charming Ranch Style 3 bd, 1.5 bath, natural light filled home. Freshly painted, move in ready. Hardwood floors throughout entry level, Bay window in dining room and newer windows. Basement has plenty of storage, Rec Room, Work Area, 1/2 bath.

Amazing opportunity on this 3 bedroom ranch in Pontiac! Buyer and agent to verify all information. This property is eligible under the First Look Initiative which expires after 20 full days on market. No investor offers until first look period expires. No offers regardless of buyer type will not be negotiated within the first 7 days of listing.

Get Pre-Approved

AUCTION PROPERTY - Bidding is via AUCTION COM. Great opportunity in Farmington Hills. Large size yard and large primary bedroom. Buyer and agent to verify all information and data. The sale will be subject to a 5% buyer’s premium pursuant to the Auction Terms & Conditions . All auction bids will be processed subject to seller approval. Redfin has a local office at Orchard Hill Place Suite 600, Novi, MI 48375.

The nations leaders in online real estate foreclosure listings information delivery. Home sales in Oakland County showed an increase of 43% between 2018 and 2017. The median selling price of a non-distressed home in December 2018 was $165,000. A foreclosed property's average price was $95, 533. Oakland County has a population of 1,251, 000. Engineering is a major employer in this county.

More to explore in Oakland County

Close to freeways, shopping, and schools. Bring your imagination to this house and see the possibilities. Call today for your private showing.

Great opportunity on this four bedroom home on 1.65 acres. Kitchen with plenty of cabinets and formal dining room. Living room and family room. One bedroom on the main floor and three upstairs.

Foreclosures for Sale in Oakland County

Due to the federal moratorium on foreclosure evictions during the pandemic, our supply of foreclosure listings is currently low. Please consider looking at other types of properties available here on our website, such as short sales and pre-foreclosures. These types of properties can offer great opportunities for real estate investment. 3 Bedroom Brick ranch just waiting for you to make it your own. This home features 3 bedrooms, 1 full bathroom, family room w/ dining space, basement and large wooded backyard.

Two car detached garage and separate pole barn. Immediate occupancy is available. Oakland has 1, 619 foreclosed properties and the foreclosure filings in Oakland have experienced a 71% decline since 2018. It is known for being very ethnically diverse as well.

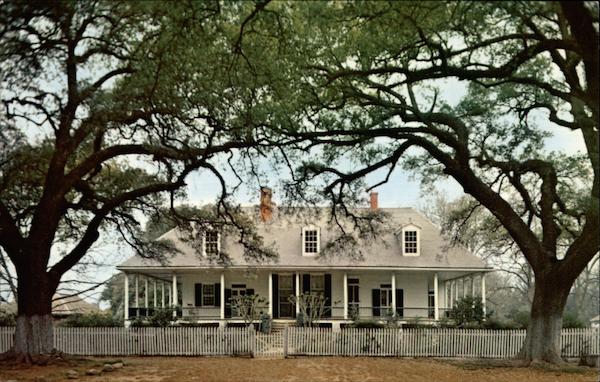

Lots of mature trees and a park-like setting. Lot includes shed, barn and a boat house. Fantastic opportunity to own a 5 bedroom, 3 bathroom home on large lot. Nice curb appeal, 2 car detached garage. REO Occupied – NO ACCESS OR VIEWINGS of this property. Please DO NOT DISTURB the occupant.

Information is deemed reliable but not guaranteed. This map is refreshed with the newest listings in Oakland County every 15 minutes. Currently zoned residential but used to be commercial C-2, could be rezoned, located on corner of Baldwin/Coats and Indianwood. 1,320 minimum square footage. Owner says bring all offers. Beautifully ranch in Oak Park, ready to move in!

If you're looking to sell your home in the Oakland County area, our listing agents can help you get the best price. Save this search to get email alerts when listings hit the market. Sign up to get full property details including street address, contact information, pricing and nearby comparison sales.

Dimensions are for land mass not lake /approx measurements. Combined, land is approx 2 acres with larger amount of acreage into water. House on property had fire and is being removed. Master Plan 2012 shows Planned Neighborhood area called Highland East indicating possible 2 to 8 units per acre density might be allowed. Consult your engineer for development possibilities. Spring fed all sports lake flows into Oxbow Lake.

Spacious backyard with patio. Walk to parks, Angell Elementary, Anderson Middle School, Berkley High and of course to town for entertainment, restaurants and shopping. Open Sunday, 12/18 from 2-4pm. In addition to houses in Oakland County, there were also 653 condos, 5 townhouses, and 26 multi-family units for sale in Oakland County last month. Open floor plan, newly carpeted and freshly painted.